Whizmo: Financial Freedom for Everyone

No bank account? No problem. Whizmo makes it simple to send money, pay bills, and make secure transactions—right from your mobile device.

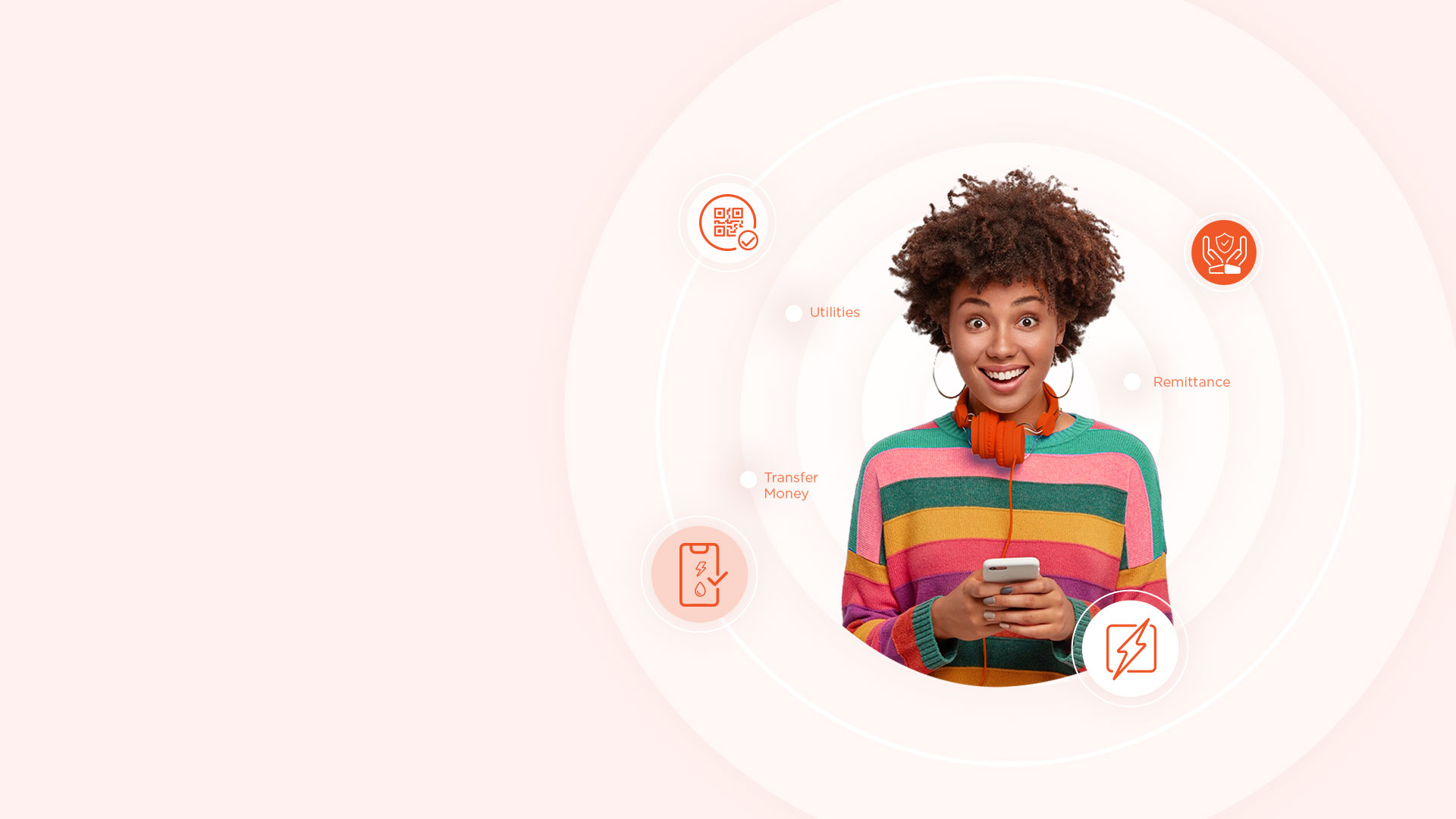

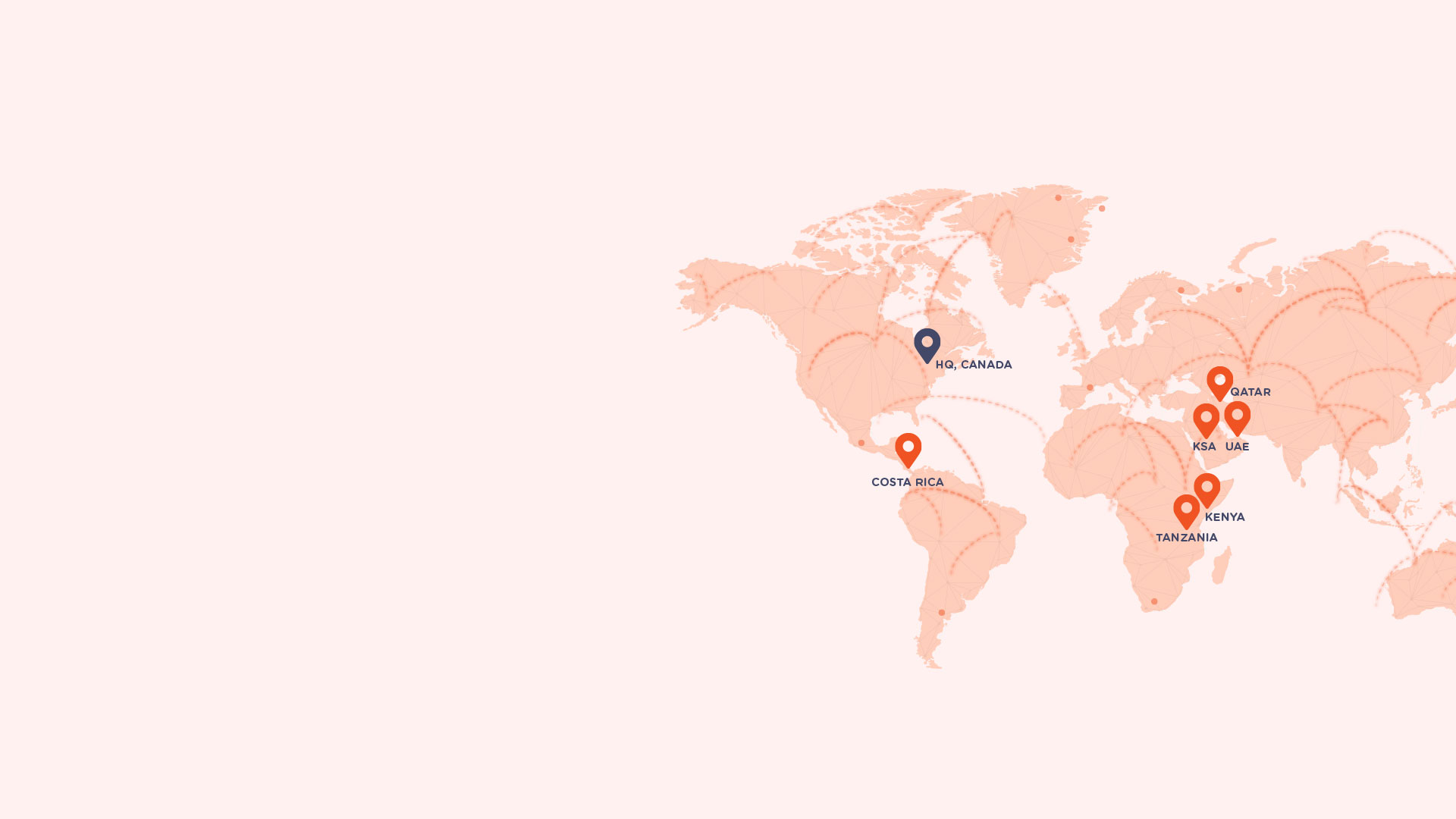

Global Access,

Local Solutions

Whizmo connects communities across borders, offering financial services that work for everyone, from sending remittances to paying bills.

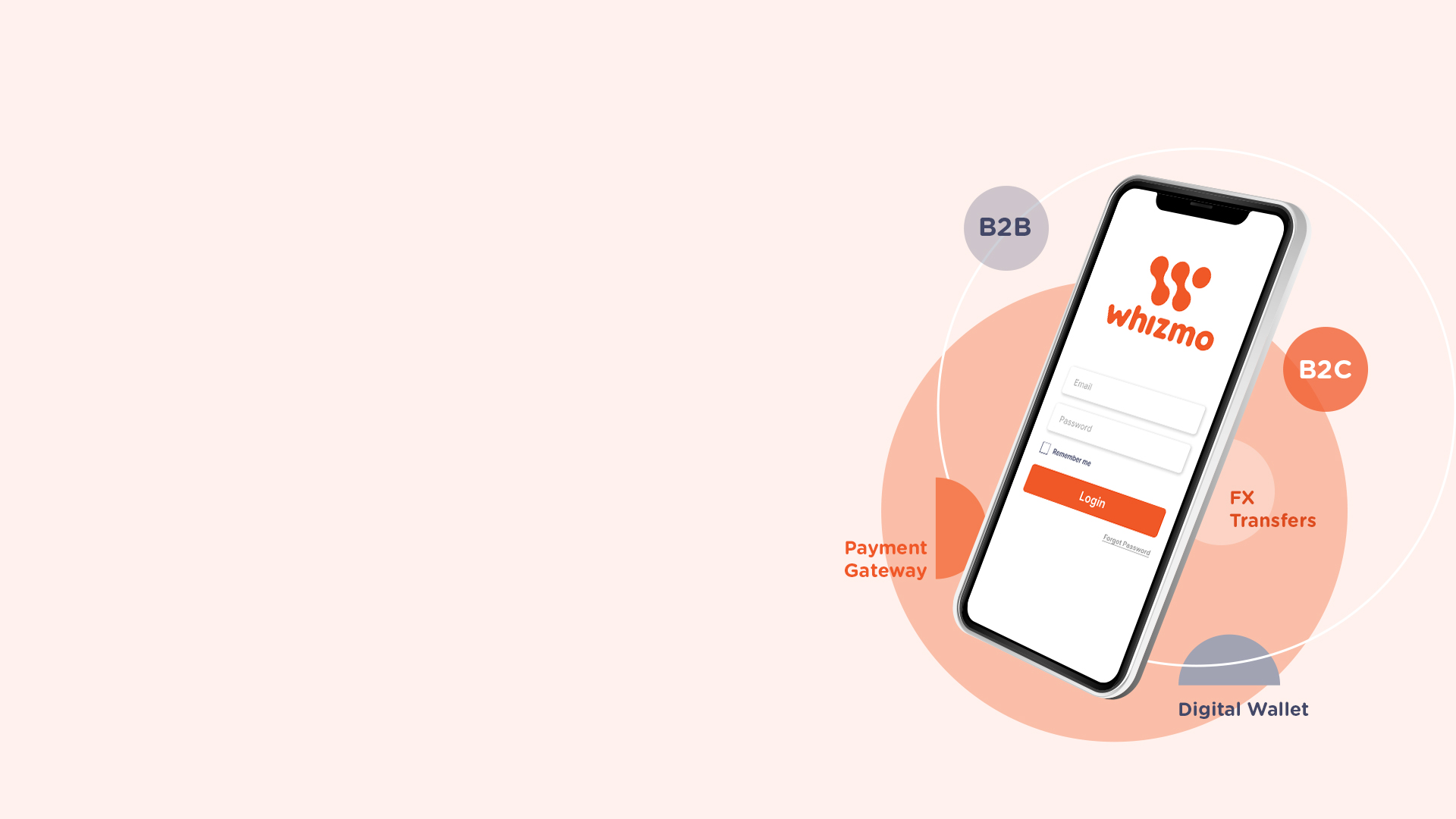

Your All-In-One

Digital Wallet

Manage your money, make payments, and send funds—all in one app. Whizmo is secure, efficient, and designed for everyone.